Silver breaks higher.

Robust investor demand is driving silver higher, but there are reasons for caution, and better ways of adding leverage than simply buying futures or silver-backed ETFs.

Ample scope for the silver bull to run…

Silver has climbed to USD 37.93/oz at the time of writing, taking the metal up 2.4%d/d and 3.8%m/m, with the metal up 23.1%y/y. The rise in silver has not been met by strength in the price of gold, pulling the Mint Ratio – the ratio of gold-to-silver – down to 88.4:1, down from a peak of 104.7:1 on the 21st of April at the height of the ‘tariff-tantrum’.

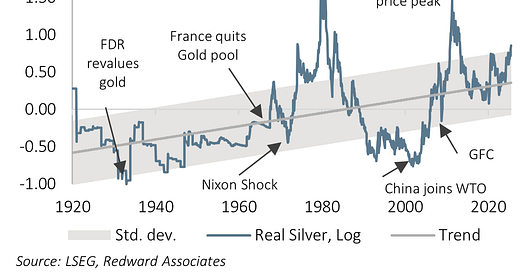

If we de-trend the USD-denominated price of silver by US headline CPI and then compare it to a de-trended average over the 1920-2025 period, we observe that silver is trading slightly expensive relative to history, but it remains well shy of the peaks observed when the Hunt brothers attempted to corner the metal, or in the post-GFC boom. To reach a similar level of over-valuation to the Hunt corner, we’d need to see silver trade in the region of USD 150/oz. That’s an awful long way off…

With silver no-longer anchored by any monetary role, and given the increasingly integrated global economy, I see no reason why silver can’t out-perform its historically fairly dismal long-term trend, meaning that the current bull market has ample scope to extend.

…driven by a supply deficit…

The Silver Institute estimates silver will post its seventh consecutive year of supply deficit this year, with supply estimated to be in shortfall by 187.6Moz, excluding Exchange Traded Products (ETPs). In February, the Silver Institute noted (see Price Sensitivity of Above-Ground Silver Stocks) that over a long period there is no correlation between the level, or change in, above-ground stocks and the price of silver. However, looking back over the past 11 years it does appear that the emergence of a supply deficit has been a factor lifting the price of silver.

…and demand for silver bullion…

In my opinion, a supply deficit won’t necessarily drive the price of silver higher. But it its occurring in an environment of easing monetary conditions, a weaker US dollar, and an expansion in global manufacturing, then the backdrop is likely to prove more favorable, increasing demand for silver bullion. The Silver Institute noted that while the correlation between bullion stocks and the silver price isn’t stable, historically, “bullion stocks are often positively correlated with the price, as investment demand grows when silver prices increase and this stimulates still higher prices.”

This appears to be the case today, with stocks of silver held in the Loco London market, in COMEX approved vaults, and in SFE warehouses has recently risen to 1,306.3Moz. While the increase observed year-to-date has been dominated by COMEX, we have also started to see a lift in loco London vault holdings, reflecting a lift in silver-backed ETF holdings.

The following is for paid subscribers only, where I discuss my trading view.

If you are curious about my work, and want to see if there’s value, why not subscribe for a month at just US$ 20.00 (less than a cup of coffee per week).

Keep reading with a 7-day free trial

Subscribe to About Gold to keep reading this post and get 7 days of free access to the full post archives.