Central Banks become even more bullish on gold.

Central Banks absorbed nearly one third of mine supply last year. Despite the rise in price, souring sentiment towards the US dollar in the WGC Survey points to solid demand from the Official Sector.

Central Bank’s rationale for holding gold hasn’t really shifted since the 2024 survey. Despite the Bank for International Settlements not classifying it as such, Central Bankers appear to view gold as a High Quality Liquid Asset (HQLA) which the BIS defines as one that “can be easily and immediately converted into cash at little or no loss of value” where “their liquidity-generating capacity is assumed to remain intact even in periods of severe idiosyncratic and market stress.”

This status is reflected in the large stock of gold held in official reserves, with many advanced countries Central Banks holding a high share of their reserves in the form of gold, while emerging countries continue to diversify their reserve holdings away from US dollars, towards gold.

Central Bankers have become more pessimistic about the outlook for the US dollar. And while they don’t anticipate its replacement as Apex currency any time soon, its dominant position as a store of wealth is likely to continue to erode.

A remarkable 95% of Central Bankers expected Central Bank holdings of gold to increase over the next twelve months, with 43% of respondents expecting their own Central Bank holdings to rise.

Central Bankers retain a strong faith in storage of gold at the Bank of England, with the bulk of gold stored in the form of Good Delivery bars.

The World Gold Council (WGC) has employed market research firm YouGuv to survey Central Bankers regarding their holdings of gold for the past eight years. This year, the survey garnered a record 73 Central Bank respondents, with the Survey conducted between the 25th of February and 20th of May. The full report from the WGC can be found (HERE).

A key component of the gold market

The World Gold Council estimates the Official Sector held 37,758.4t of gold as of end-2024, 17.5% of total above-ground stocks. Central Bank holdings increased 1,044.6t last year, consistent with the continuation of the trend observed post-Russian invasion of Ukraine of large-scale Central Bank purchases; the average in the decade pre-invasion was 511.9t per annum against a post-invasion average of 974.8t.

In 2024, the Official Sector purchased 28.4% of total mine supply and 20.9% of total overall supply (including recycling and producer hedging). While Central Bank purchases are dwarfed by jewelry buyers, they’ve nearly caught up with private sector purchases of physical bar and coin.

The stock of Central Bank holdings remains dominated by OECD countries, with the five largest holders remaining the United States (8,133.5t), Germany (3,351.5t), the IMF (2,814t), Italy (2,451.8t), and France (2,437t). While IMF SDR allocations are global, they remain dominated by developed countries, with the EU-27 (26.18%), US (17.42%), Japan (6.47%), UK (4.23%), and Canada (2.31%) comprising 56.61% of the SDR allocation, and indirectly, the Fund’s gold holdings.

While the stock of gold remains held largely by developed countries, the flow of gold into Central Bank reserves is dominated by emerging and frontier countries. The largest reported buyers of gold in 2024 were Poland (89.5t), Türkiye (77.4t), India (72.6t), Azerbaijan (44.8t), and China (44.2t) while we saw modest selling from the Philippines (-28.6t) and Kazakhstan (-10.2t).

Central Banks to add to holdings

The WGC Survey asked two questions about Central Bank gold holdings over the next twelve months: i) whether Central Banks expect the sector’s holdings to increase, and: ii) whether their own institution will add to exposures.

In the former case, fully 95% of respondents expected holdings to increase over the next twelve months, with only 5% expecting no change. That’s up from just 52% expecting an increase when the survey was conducted in 2021. When asked about their own institution, the number of respondents expecting their Central Bank to buy gold jumped from 29% in 2024 to 43% today, with the share unchanged falling from 68% to 57% and none expecting a decrease. As there is likely to be some sensitivity among Central Bankers about discussing their own activities in the gold market, and many developed country respondents are likely to come from Central Banks with no plans to increase holdings, this represents a significant jump, suggesting that Central Banks are likely to remain active buyers of the metal, likely providing support on any weakness.

When asked about what proportion of total reported reserves (currently 19%) will be held in gold in five years, few (7%) respondents expected holdings to be smaller, while there were some respondents expecting holdings to be unchanged (16%) but the bulk of respondents (70%) expected holdings to increase to 20-25%, with a small percentage (5%) expecting holdings to be greater than 25%.

The decision to hold gold reflected to a large extent its legacy asset status (58%) but the allocation decision was also heavily influenced by the Central Bank’s executives and executive board (59%), with some central banks deciding to hold gold as a result of a strategic allocation (39%), or an investment committee recommendation (27%), with some (24%) resulting from a domestic gold purchase program.

Central Banks report the bulk of gold is held as Good Delivery bars (88%) with some held in Coins and Ingots (15%), Dore (7%), and Kilobars (7%) consistent with the fact that the Bank of England (64%) remains the preferred vault, followed by domestic storage (59%), the Federal Reserve Bank of New York (17%), Bank for International Settlements (14%), and Swiss National Bank (12%). Note: Figures don’t necessarily add to one as Central Banks may have more than one factor governing their determination to hold gold and are likely to diversify their holdings via multiple vaults.

Rationale for holding gold

When looking at their overall level of reserves, return considerations such as interest rates (93%) and inflation (81%) continue to dominate concerns around risk, but risk concerns are increasing, including geo-political instability (77%), potential trade conflict (59%), and shifts in global economic power (34%), while ESG concerns (41%) are also evident, notably among developed country Central Banks (% of respondents answering yes, in brackets). Simply put, gold is viewed as an attractive long-term store of value that provides diversification, performs well in a crisis, and offers a liquid instrument, with no default risk, and is therefore valuable collateral.

Comments from respondents indicated that “geopolitical and inflationary risks” associated with a “multipolar”, “uncertain and volatile world” create an environment where Central Bankers see value in “reducing dependence on the US dollar.”

When asked about the rationale for Central Banks who don’t hold gold in their reserves, respondents without gold holdings noted a preference for higher yielding assets, concerns about holding costs (vaulting, custody fees), a lack of understanding of the gold market, concerns about accounting and valuation of the asset, and their investment remit.

Dollar holdings to fall

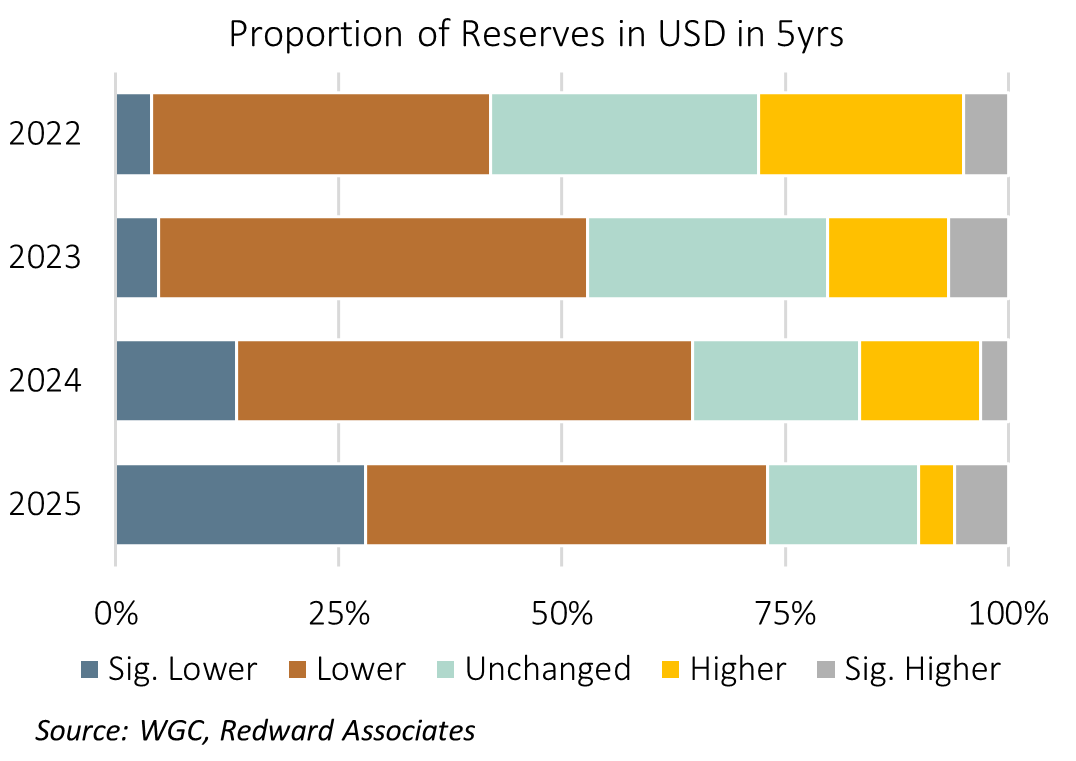

Central Bankers have become much more pessimistic about the outlook for the US dollar. The proportion of respondents expecting the US dollar’s share of reserves to be significantly lower in five years has surged from 5% in 2023, to 28% today. When coupled with those who expect its share to be lower, the joint probability has risen from 55% in 2023, to 73% today.

While de-dollarization is not considered to be a primary rationale for holding gold, a range of concerns around the US dollar appear evident, including concerns about the dollar’s role as a store of value, it’s political risk, concerns about sanctions, and concerns about the international monetary system. While it’s hard to see the US dollar losing its role as the apex currency, with the dollar likely to remain the primary unit of account, means of international exchange, and source of debt capital raising, it’s role as a store of value in reserves looks set to diminish, with Central Banks moving towards a range of other currencies, and gold.

The information in this publication is provided by Redward Associates Private FZCO for informational purposes only. The insights contained in this publication are not investment advice and should not be construed as such, nor as a recommendation for any specific investment product. Our full disclaimer can be found HERE.